Main Street Macro: People are buying less stuff. That might matter for inflation.

June 24, 2024

|

Over the last four years, Main Street’s elevated consumption of durable goods has had both plusses and minuses for the economy.

On the plus side, consumer spending on items such as electronics, refrigerators, and new cars helped pull the U.S. economy from the depths of the pandemic downturn into three years of robust growth. The durable goods share of GDP—economists define durable goods as items that last at least three years—peaked at 8.8 percent during the pandemic, a big jump from its 6.8 percent share in the quarter preceding the pandemic.

On the minus side, consumer demand soon outstripped supply as the manufacture and shipment of durable goods were constrained by a pandemic-driven logjams. The result was a surge in prices that caused inflation to climb from around 2 percent to more than 9 percent.

One reason inflation has fallen since is that supply improved just as consumers pulled back from their frenetic spending on durable items. In April, year-over-year durable goods spending had fallen for three out of the last four months.

These days, the supply of durable goods is much more aligned to demand. The durable goods share of GDP has retreated to 7.7 percent – still higher than pre-pandemic levels.

Meanwhile, services have replaced goods as the main driver of inflation.

Because durable goods purchases are expensive, they’re more likely to be financed than the purchases of services or non-durable goods. That means higher interest rates might be contributing to the slowdown in purchases of big-ticket items.

A deeper slump in durable goods spending could test the economy’s ability to maintain its robust pace of growth in 2024. And a shift to even more consumer spending on services could bode ill for inflation if the labor market remains tight.

The homeownership factor

Housing is a big driver of durable goods spending. When you buy a home, you also buy a lot of other stuff, such as furniture, or maybe a new refrigerator.

Home prices hit a record high in May, according to the National Association of Realtors, and sales have been low due to higher interest rates and low inventory.

Despite these challenges, homeownership has had a big demographic tailwind over the past two years.

Millennials, who are in their peak home-buying years, have help push the U.S. homeownership rate above 2019 levels, according to the US Census. The biggest change, a whopping 3 percentage point increase in homeownership, came from millennials aged 40 to 44.

This influx of new homeowners has grown the ranks of the durables consumer, who are on the hook for replacing the broken dishwasher and buying bedroom furniture.

Doing more, acquiring less

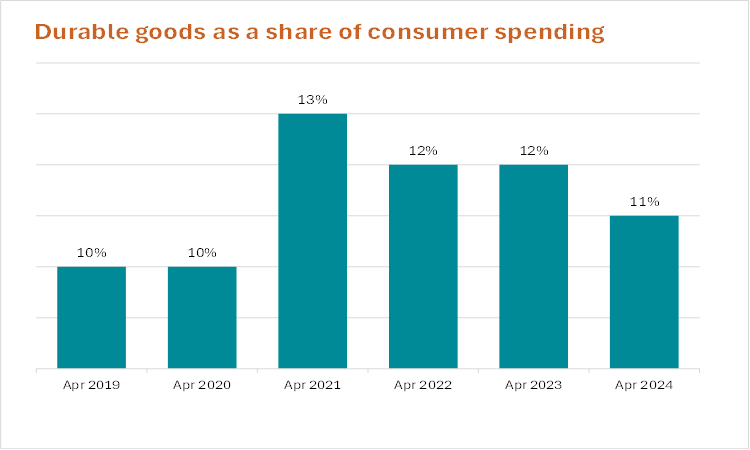

Consumer spending overall was up 5 percent in April from a year earlier, but the mix of what people are buying has changed. Spending on services rose to 69 percent of total spending, up from 67 percent in 2023 and 65 percent in 2022, while durables as a share of total spending fell to 11 percent from 12 percent, putting us on track to return to pre-pandemic spending levels.

My Take

I’ve said it before: Consumers have been incredibly resilient over the last three years, taking on inflation and price increases with aplomb.

But enduring high prices and interest rates at a two-decade high could be eroding consumer durability and could slow their spending on durable goods.

The economy can grow even if consumer purchases trend even more strongly toward services. But nothing in economics comes without cost.

Unlike an expensive item that has a lot of different inputs, the primary input for services is labor. If demand for services outstrips the supply of labor, hard-fought wins on inflation could reverse.

The week

Monday: ADP Research takes a look at local job markets for college graduates. Sam Adieze and Ben Hanowell identify the best metros for recent grads in a cooling market.

Wednesday: The Census Bureau releases new home sales for May, giving a fresh read on whether current homebuyer enthusiasm is holding up against elevated mortgage rates. New construction historically makes up about 10 percent of home sales, but low inventory has caused the share of new homes as a percentage of total for-sale housing to triple, making it a more important barometer.

Thursday: The Census Bureau releases durable goods orders for May, giving us a supply-side view of what could be in store for the second half of the year.

Friday: The week’s headliner is the Bureau of Economic Analysis release May’s measure of PCE inflation, the Federal Reserve’s preferred inflation measure. With inflation edging closer to 2 percent, the Fed is still in wait-and-watch mode.

I’ll also be watching the BEA’s May personal income and spending data on Friday for any signs of a rebound from last month’s slump. An incremental shift in spending toward services and away from goods won’t likely hamper the economy this year, but an outright slowdown in overall spending certainly could.